Persistence aims to leverage institutional and crypto-native liquidity in the dApp layer in a two-step approach. They aim first to bring the benefits of public blockchain technology to institutional use cases, to take advantage of institutional liquidity, and second to bring institutional products to crypto native stakeholders, leveraging retail liquidity.

In the real world, you can use real-world asset collateral to help secure short-term financing. In the crypto ecosystem you can only borrow stablecoins by placing other crypto assets as collateral (often used). But one problem with crypto assets is that traders and SME businesses are still unable to use crypto regularly. Most of the time the user has to pay for expensive gas and also requires additional knowledge of the system. And lastly, there is still a lot of uncertainty with cryptos which makes it really complicated. Having said all that, data is also an important issue. Data leaks and malicious activity have also hindered DeFi's development, making it very difficult for other platforms to try to solve this problem.

Mission & Vision

The Internet separates the Media & Communications industry. Using HTTP, SMTP and TCP / IP as the base layer, the cost of exchanging information is significantly reduced.

Persistence leverages blockchain technology to facilitate seamless exchange of assets. Using the Web 3.0 protocol, Persistence aims to activate and create a range of cutting-edge financial products ranging from staking-as-a-service and tokenized 'real-world' debt to digital art.

What's interesting about Persistence?

Products in the Persistence ecosystem include:

Comdex: Comdex is a decentralized commodity trading solution for businesses, covering the entire transaction process including buyer / seller connections, transaction confirmations and payments. Comdex is currently the most successful app in this segment, with a total transaction volume of over $ 55,000. You can see, this is a very new segment and has a lot of growth potential, as the transaction volume of the leading app is just over 50 thousand dollars.

pStake: This product helps to open up staking liquidity on chains operating under the Proof-of-Stake mechanism, thereby helping users increase their profit chances from token staking. More than $ 450 billion is at stake across the market, and this will be a great opportunity for this product to grow.

As far as I can see, this is a product with great growth potential, as the demand for unlocking liquidity is very high. This will be a very important part of this ecosystem.

AUDIT.one: This is a product that provides a betting solution (Staking-as-a-Service). The company provides staking solutions to investment companies and funds, and currently supports more than $ 250 million in assets across more than 10 different networks.

Asset Coat: (Develop Products) NFT Market helps users create their own NFT shop. Allows NFTS in different networks to be transacted, from electronic images, tickets, music, ...

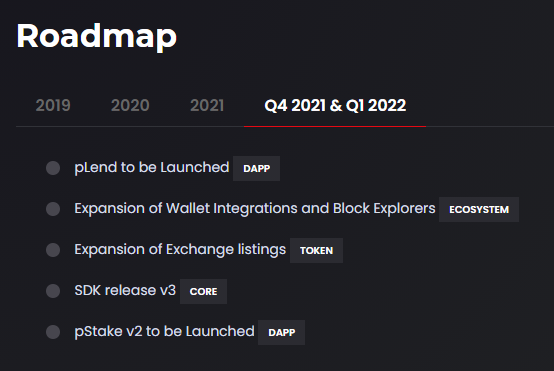

pLend: (Develop Product) pLend is a stablecoin product created from real-world asset mortgages.

As you can see, the Persistence protocol package is aimed primarily at companies and hedge funds with a large need for market entry, and interaction with DeFi. All products have very practical applications.

Most likely, Persistence will choose the same development path as its fellow Terra-hit users to solve problems facing financial services such as long payment times, lack of transparency and demand. ask for trust.

Persistence is an interoperable middleware that provides a sovereign environment to develop and operate DeFi application. Persistence technology was created by recognizing all the problems currently facing in the DeFi space. The Persistence technology stack consists of three components:

- PersistenceOne Chain (s) - a sovereign business-specific "application chain" network with security provided by the main chain and Persistence validators

- PersistenceOne SDK - complete suite of plug-and-play modules for creating new ones or integrating into Exchange & Marketplace

- PersistenceOne dApps - a financial application that focuses on retail and institutional stakeholders.

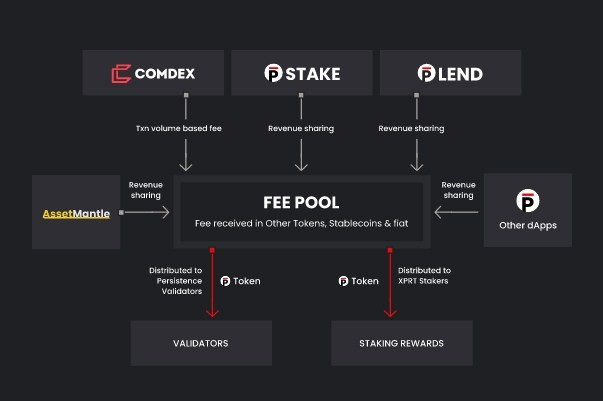

The XPRT token is basically a governance token for the Persistence chain. Once the Persistence mainnet is launched, token holders will be able to stake XPRT tokens to passively earn more XPRT. The XPRT token also plays the role of a 'working token', allowing shareholders to generate cash flow in relation to the volume of transactions generated by dApps in the Persistence ecosystem.

Work Token

XPRT Staker benefits from economic activities that occur in the Persistence ecosystem (Economic activity of Persistence dApps or pApps). Persistence has a revenue-sharing / transaction volume agreement based on all dApps in its ecosystem. This increased activity on dApps (pApps) results in more rewards in the form of staking rewards and additional incentives for validators. This leads to the accrual value for XPRT.

Why Stake XPRT?

XPRT is a deflation token with a genesis supply of 100,000,000 XPRT and a maximum supply of 403,308,352 XPRT. Initial inflation for XPRT will range between 25-45% with an inflation target of 35% achieved at 66.7% of the total XPRT supply staked on the Persistence chain.

The inflation halving occurs every two years and the maximum supply limit is expected to be reached by 2035. XPRT Staker will be able to get around 35% staking rewards for the first two years.

Token Distribution

- Validators / Strategic Round Sales: 10,000,000 XPRT, 10.0% of Total Supply in Genesis at genesis, $ 0.1 per token

- Seed Round Sale: 8,000,000 XPRT, 8.0% of Total Supply on Genesis, $ 0.15 per token

- Private Round Sale: 6,000,000 XPRT, 6.0% of Total Supply on Genesis, $ 0.25 per token

- Public Round Sale (Auction): 1,000,000 XPRT, 1.0% of Total Supply at Genesis

- Team: 16,000,000 XPRT, 16.0% of Total Supply at Genesis

- Advisor: 4,000,000 XPRT, 4.0% of Total Supply at Genesis

- Ecosystem: 19,400,000 XPRT, 19.40% of Total Supply in Genesis

- Marketing / Growth: 25.6 million XPRT, 25.6% of Total Supply in Genesis

- Validator Incentive: Validator Incentive: 10,000,000 XPRT, 10.0% of Total Supply in Genesis

A total of 100,000 XPRT Persistence tokens (worth $ 25,000 at the most recent assessment), will be allocated for distribution to KAVA shareholders during the campaign. Each KAVA holder will be eligible to earn up to 5,000 XPRT tokens, simply by staking on the Kava network.

Main Details:

- Total prize pool: 100,000 XPRT ($ 25,000 based on recent assessment)

- Campaign duration: 21 days

- Start date and time: 26 November 2020, 12:00 AM PST (Block Height: 453,621)

- End date and time: 16 December 2020, 11:59 PM PST (Block Height: 672,440)

- Start date and time of Magic Transaction: 23 November 2020, 00:00 PST (Block Height: 422,360)

- Network Prize Pool: 80,000 XPRT

- AUDIT.one Rewards Pool: 20,000 XPRT

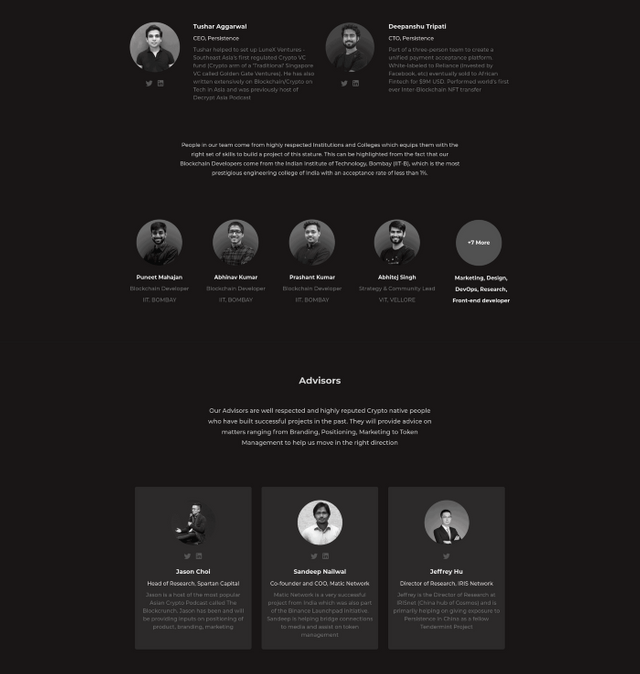

TEAM

Detail Information:

- WEBSITE : https://persistence.one

- ANN THREAD : https://bit.ly/3mKA5w6

- TWITTER : https://bit.ly/3tliDAX

- TELEGRAM COMMUNITY : https://bit.ly/3a9u0o4

- DISCORD : https://bit.ly/3g3xIDw

- REDDIT : https://bit.ly/2Ro0lRp

- YOUTUBE : https://bit.ly/3tlcSmI

- MEDIUM : https://bit.ly/2RpwvvQ

- LINKEDIN : https://bit.ly/3dgfKM7

Username : pijayplow93

Profile : https://bitcointalk.org/index.php?action=profile;u=2750501

Persistence wallet address : persistence1t62jngcndqypzcrlj39qlmq950jcjfl0cyrcdj

USDT wallet address : 0xEfd7255D5b89Ceffa7d0E297b556286C143e779B

Profile : https://bitcointalk.org/index.php?action=profile;u=2750501

Persistence wallet address : persistence1t62jngcndqypzcrlj39qlmq950jcjfl0cyrcdj

USDT wallet address : 0xEfd7255D5b89Ceffa7d0E297b556286C143e779B

No comments:

Post a Comment