It is no news that Yield farming is an aspect of DeFi that involves “putting cryptoassets to work” by placing them into autonomous financial protocols to leverage strategies such as lending, providing liquidity, and staking to maximize returns. Decentralized finance (DeFi) on the other hand, has added a fresh layer of enthusiasm for crypto, and regardless of the numerous clubhouse sessions and think pieces on its viability, what is clear is that we now have new ways of generating returns in the crypto markets other than trading and HODLing. One such way is yield farming.

The benefits of yield farming are immediately apparent profit. Yield farmers who are early to adopt a new project can benefit from token rewards that may quickly appreciate in value. If they sell those tokens at the right time, significant gains can be made. Those gains can be reinvested in other DeFi projects to farm yet more yield.

Yield farmers generally have to put down a large value of initial capital to generate any significant profits even hundreds of thousands of dollars can be at stake.

With that being said, Rabbit Finance is a leverage yield farming protocol built on the Binance Smart Chain. It allows yield farmers to earn higher return by opening a leverage position.

But before we go any further, please check out this video presentation to get even more acquainted

Now that I have your attention, let’s get right to it.

What exactly is Rabbit Finance?

As depicted earlier and as illustrated in the official website of Rabbit Finance, Rabbit Finance is a leverage yield farming protocol built on the Binance Smart Chain. It allows yield farmers to earn higher return by opening a leverage position.

Furthermore, Rabbit Finance allows users to participate in growing DeFi's liquidity when their funds are insufficient. Rabbit Finance can provide up to 10x more leverage to help users maximize their return on investment. However, for users who want a stable profit, Rabbit Finance provides a loan pool where users can make a stable profit to make a profit.

Rabbit Finance is a combination of various popular projects in the market such as Alpaca Finance and Badger Finance and combined with a stablecoin algorithm engine. In this way, Rabbit Finance enables Rabbit Finance to become a reliable and profitable DeFi platform for all participants and even become the "Federal Reserve of the DeFi World" thanks to affordable, innovative and equal financial services for any person or group worldwide.

The Rabbit Finance Features

Rabbit Finance is a leveraged yield farming protocol built on the BSC platform that makes it fast, secure and affordable. With the leveraged yield farming feature provided by Rabbit Finance, it allows users to achieve revenue per unit of time when their funds are insufficient and at the same time provides a loan facility for those who want a stable return. In this way, it enables global users to be able to maximize their profits easily and affordably.

The following are Rabbit Finance's features:

Flexible deposit options

Rabbit Finance designs the vault optimally converts user-stored assets and borrowed BNB or BUSD. So that users don't need to do the conversion themselves.

Auto-betting

The Rabbit Finance mechanism allows betting of LP tokens for users on selected platforms (PancakeSwap, etc.) automatically. So that users can get rewards as soon as possible.

Continuous compounding

Bounty hunters have the role of monitoring the number of gifts earned in each batch and helping farmers to reinvest them.

Claim RABBIT rewards anytime

Rabbit Finance allows users to claim their bonus rewards at any time.

About Rabbit Finance Strength and Vision

Rabbit Finance fully exploits and adopts the advantages of projects in the market, using over-leveraged agricultural products with the advantages of Alpaca Finance and Badger Finance, creatively incorporating an algorithm-stable coin mechanism to empower the RABBIT token. Across the economic ecology of Rabbit Finance, the RABBIT token, endowed with more application scenarios, represents not only the governance rights and interests of the leveraged farming protocol, but also the rights and interests of token shareholders of the RUSD algorithm stable coin. Whenever the RUSD experiences inflation, members who pledge R tokens to the meeting room will distribute additional RUSD as dividends to share the benefits of ecological growth.

- Alpaca Finance + Badger Finance + StableCoin Algorithm

- leveraged lending + Yield Farming + Algorithm mechanism

Rabbit Finance's vision is to become the Federal Reserve of the DeFi world, based on the principles of equal opportunity and commercial sustainability, and to provide appropriate and cost effective financial services to people of all social strata and groups who need financial services. Rabbit Finance is not a simple leveraged farming platform or an algorithmically stable coin system. It will be a decentralized and inclusive financial services infrastructure with sustainable hematopoiesis capabilities and based on blockchain technology. Compared to the same role as the Fed, what Rabbit Finance expects goes far beyond the role of the Fed in the world economy.

About The RABBIT Token

RABBIT is a token issued by Rabbit Finance which will act as a governance token as well as the "fuel" that will support Rabbit Finance's operations. RABBIT token based on Binance BEP-20 with a total volume of 200 million Rabbit tokens. RABBIT is slated to act as a governance and reward token.

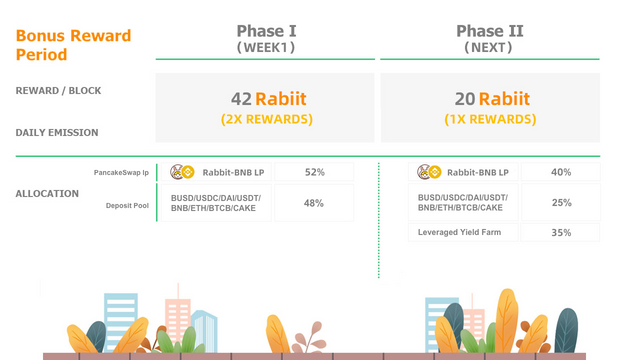

Bonus Period

Open deposit vaults & pancakeswap liquidity pool, emission rate: 42 RABBIT /block. It lasts about one week.

Token Utilization

Protocol Governance

Rabbit Finance will soon launch a governance vault that will allow community members to stake their RABBIT tokens. The RABBIT staker will receive xRABBIT where 1 xRABBIT = 1 vote, allowing them to decide on key governance decisionsIn the initial phase, governance decisions will be made on Snapshot.

Capture Economic Benefits of the Platform

Users of Rabbit Finance Protocol (depositors and borrowers, i.e. lenders and farmers) will be rewarded with RABBIT token for their deposit and borrow behaviors. Rabbit Finance platform will set up a buyback fund with its income, which will be used for deflation and appreciation of RABBIT token. When earnings is reinvested, 30% of that is used to RABBIT repurchase fund. The 20% of the depositor’s interest income is used as market development fund. All of these will contribute to RABBIT's demand increase and value growth.

Capture Economic Benefits of the RUSD, RBTC, RBNB etc.

RABBIT token is the shareholders' rights token of algorithm stable coin of RUSD, RBTC, RBNB etc. Whenever RUSD etc. is inflationary, the members who pledge RABBIT token to the boardroom will share the additional RUSD as dividends to share the benefits of ecological growth. For more details, please pay attention to the follow-up announcement.

Disclaimer: This article was published in terms of the bounty campaign. I am not a project team member or its representative but a supporter of this incredible project.

Be a part of this incredible project. Download the whitepaper for the full scoop.

Till next time…

For more information, please visit:

- WEBSITE: http://rabbitfinance.io/

- TWITTER: https://twitter.com/FinanceRabbit

- TELEGRAM GROUP: https://t.me/RabbitFinanceEN

- GITHUB: https://github.com/RabbitFinanceProtocol

- DISCORD: https://discord.gg/tWdtmzXS

- WHITEPAPER: https://app.gitbook.com/@rabbitfinance/s/homepage/

- CONTRACT: https://app.gitbook.com/@rabbitfinance/s/homepage/resources/contract-information

- AUDIT: https://app.gitbook.com/@rabbitfinance/s/homepage/resources/audit-report

Profile : https://bitcointalk.org/index.php?action=profile;u=2750501

BSC Wallet Address: 0x476366b6839e2046bE2DCf258476633cAE21195e

No comments:

Post a Comment